food tax in massachusetts calculator

Companies or individuals who wish to make a qualifying. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate.

Oregons sales tax rates for commonly exempted items are as follows.

. Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Delaware Sales Tax Exemption Form to buy these goods tax-free. The OR sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. Delaware Sales Tax Exemption Certificate Unlike a Value Added Tax VAT the Delaware sales tax only applies to end consumers of the product.

Massachusetts Income Tax Calculator Smartasset Com Income Tax Income Tax

Related

- pitbull puppies for sale in tri cities wa

- midnight in the garden of good and evil movie streaming cast

- Blood-red sky in China

- morning vibes quotes in hindi

- oklahoma franchise tax phone number

- garage flooring pros sarasota

- lalitha sahasranamam telugu pdf with meaning

- coast to coast customs motorcycles

- local foods kitchen thanksgiving

- quentin one tree hill how did he die

North Carolina Sales Tax Small Business Guide Truic

Massachusetts Income Tax Calculator Smartasset

Live In Nh But Work In Ma What To Know About Your State Tax Returns Milestone Financial Planning

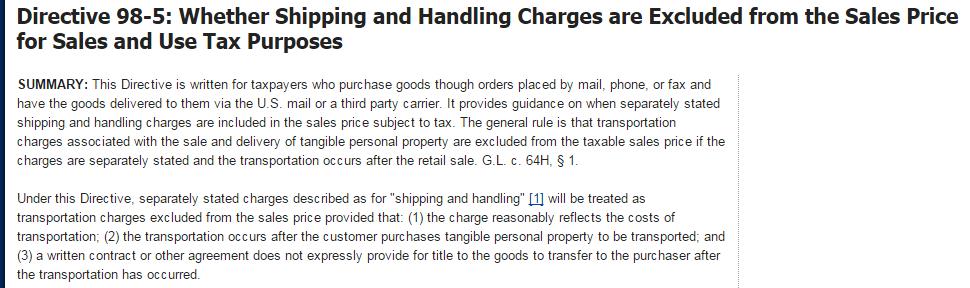

Is Shipping Taxable In Massachusetts Taxjar

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Which States Made The Most Tax Revenue From Marijuana In 2018 Infographic

Massachusetts Income Tax Calculator Smartasset

Is Shipping Taxable In Massachusetts Taxjar