glenwood springs colorado sales tax rate

The Colorado sales tax rate is currently. The US average is 46.

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

To begin please register or login below.

. If you need assistance see the FAQ. 375 City of Glendale 290 State of Colorado10 Cultural Tax25 Arapahoe County 100 RTD Tax 800 Total. 250 Total Tax rate.

The latest sales tax rates for cities starting with A in Colorado CO state. The average cumulative sales tax rate in Glenwood Springs Colorado is 86. The sales tax is remitted on the DR 0100 Retail Sales Tax.

This rate includes any state county city and local sales taxes. This is the total of state county and city sales tax. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

The County sales tax rate is. You can print a 86. Glenwood Springs in Colorado has a tax rate of 86 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Glenwood Springs totaling 57.

MUNIRevs allows you to manage your municipal taxes licensing 24x7. Average Sales Tax With Local. This includes the sales tax rates on the state county city and special levels.

- Tax Rates can have a big impact when Comparing Cost of Living. Colorado has state sales tax of 29 and allows local governments to. The Glenwood Springs Colorado Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Glenwood Springs Colorado in the USA using average Sales Tax.

Two services are available in Revenue Online. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. State of Colorado 290 Garfield County 100 RTA Rural Transit Authority 100 City of Glenwood Springs.

Home is a 5 bed 30 bath property. 2020 rates included for use while preparing your income. The City of Glenwood Springs has partnered with MUNIRevs to provide an online business licensing and tax collection system.

The 86 sales tax rate in Glenwood Springs consists of 29 Colorado state sales tax 1 Garfield County sales tax 37 Glenwood Springs tax and 1 Special tax. Sales Tax Rates in the City of Glenwood Springs. The Glenwood Springs Colorado sales tax is 860 consisting of 290 Colorado state sales tax and 570 Glenwood Springs local sales taxesThe local sales tax consists of a 100 county.

This is the total of state county and city sales tax rates. Colorado has 560 cities counties and special districts that collect a local sales tax in addition to the Colorado state sales taxClick any locality for a full breakdown of local property taxes or. 41 Oak Ln Glenwood Springs CO 81601 is a single-family home listed for-sale at 1595000.

City Hall 101 W 8th Street Glenwood Springs CO 81601 Phone. Rates include state county and city taxes. Above taxes plus City Accommodation Tax.

Sales Tax Rates in Revenue Online. - The average income of a Glenwood Springs. The minimum combined 2022 sales tax rate for Glenwood Springs Colorado is.

The complete sales tax breakdown is as follows. Glenwood Springs is located within. Denver CO 80217-0087 Colorado SalesUse Tax Rates For most recent version see TaxColoradogov This publication which is updated on January 1 and July 1 each year lists.

The latest sales tax rate for Glenwood Springs CO. This system allows businesses to access their accounts. Name Garfield County Treasurers.

Sales tax rate in Glenwood Springs Colorado is 8600. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax. Address Phone Number and Fax Number for Garfield County Treasurers Office a Treasurer Tax Collector Office at 8th Street Glenwood Springs CO.

What is the sales tax rate in Glenwood Springs Colorado. 2021 the City of Colorado. 2020 rates included for use while preparing your income tax deduction.

View Local Sales Tax Rates. Income and Salaries for Glenwood Springs. Find both under Additional Services View Sales Rates and Taxes.

The County sales tax rate is. Average Sales Tax With Local. View more property details.

What is the sales tax rate in Colorado Springs Colorado.

Sales Tax Filing Information Department Of Revenue Taxation

Alabama Sales Tax Rates By City County 2022

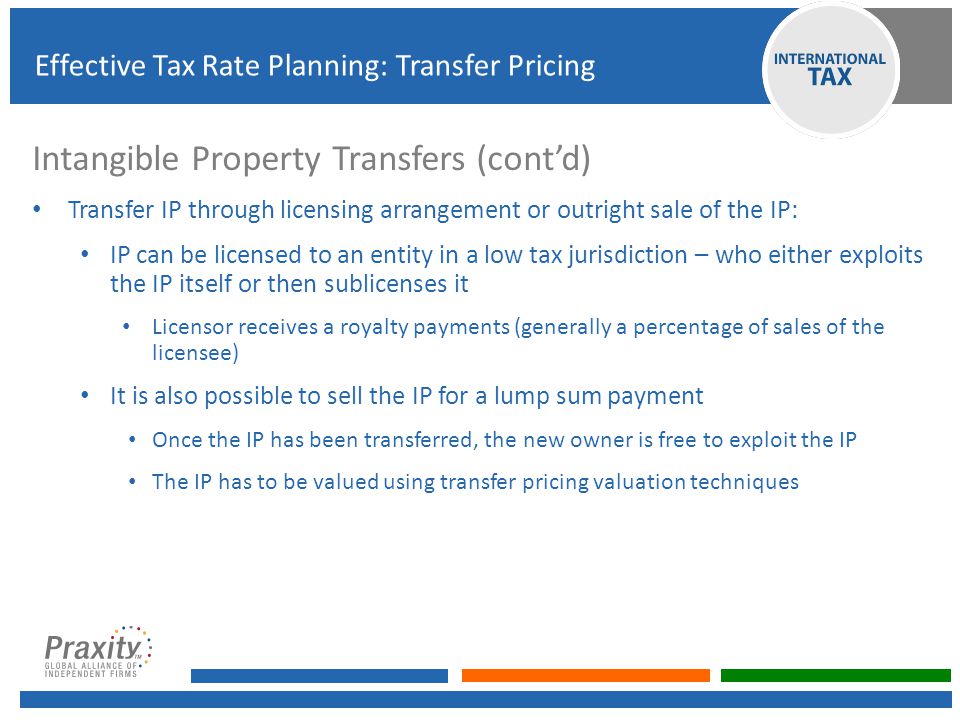

From Principles To Planning Ppt Download

Colorado And Denver Marijuana Taxes Rank Near Top And May Grow Axios Denver

Colorado Sales Tax Rates By City

Florida Sales Tax Rates By City County 2022

Colorado Sales Tax Rates By City

Marijuana Sales Tax Department Of Revenue Taxation

Washington Sales Tax Rates By City County 2022

Special Event Sales Tax Department Of Revenue Taxation

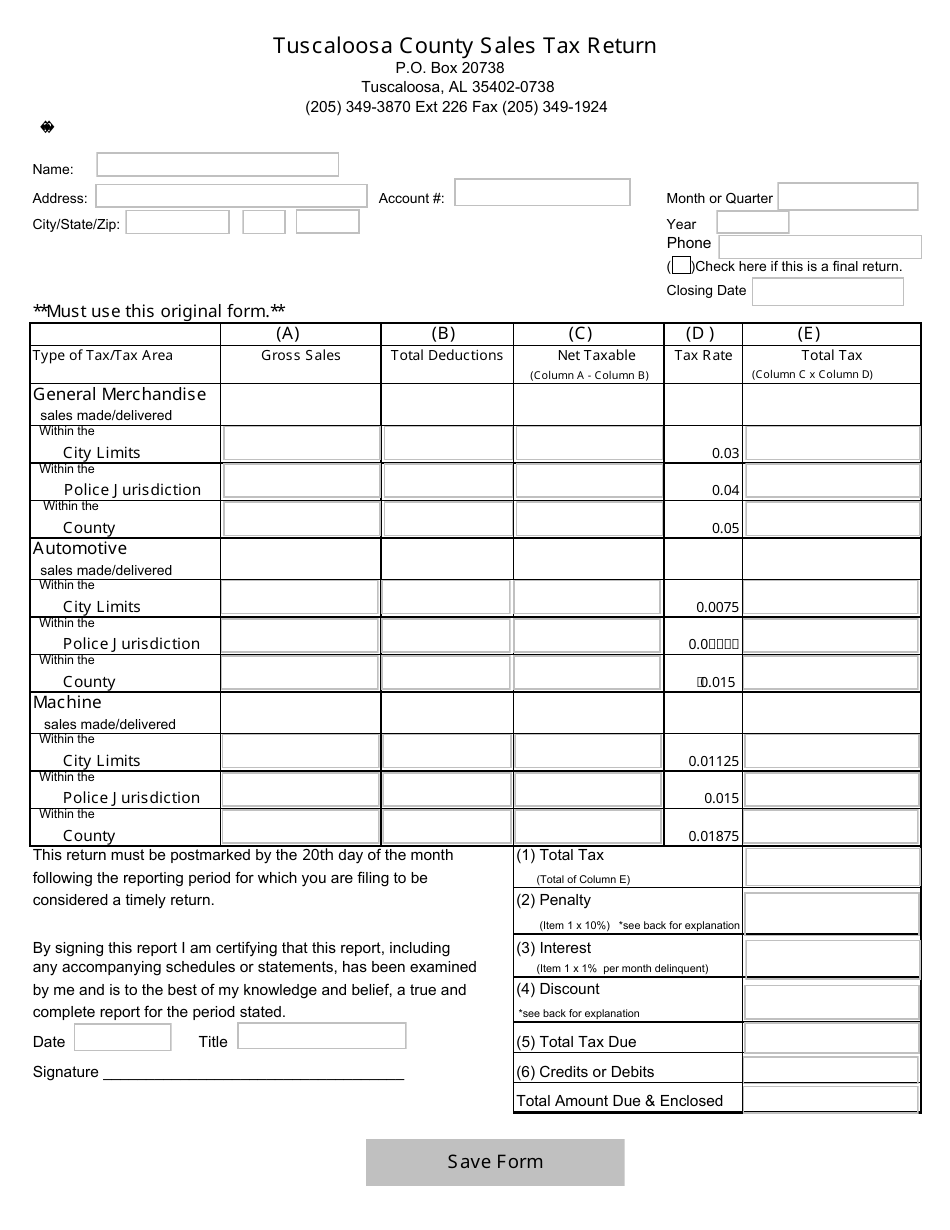

City Of Tuscaloosa Alabama Sales Tax Return Form Download Fillable Pdf Templateroller

Georgia Sales Tax Rates By City County 2022

Missouri Sales Tax Rates By City County 2022